Master Your Finances with a Minimalist Budget Planner

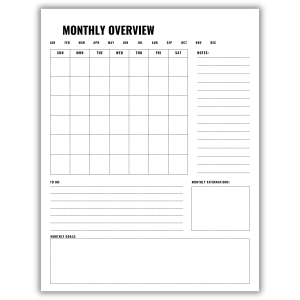

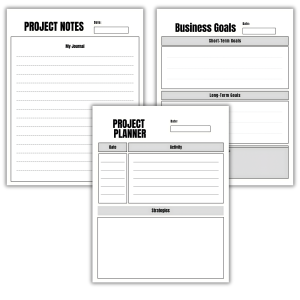

Take charge of your financial future with this 120-page Minimalist Monthly Budget Planner. Designed for clarity and ease of use, this clean, monochrome organizer helps you track every dollar without the confusion of complicated spreadsheets.

Sized to standard 8.5×11 inches with no bleeds and high-resolution 300 DPI, it provides a professional, distraction-free layout to map out your income, expenses, and savings goals.

Whether you are managing household bills, tracking small business cash flow, or saving for a dream vacation, this budget planner adapts to your financial journey.

Delivered in PDF Standard for easy digital storage, PDF Print RGB for tablet use, and CMYK for crisp KDP or home printing, it is the essential tool for building wealth one month at a time.

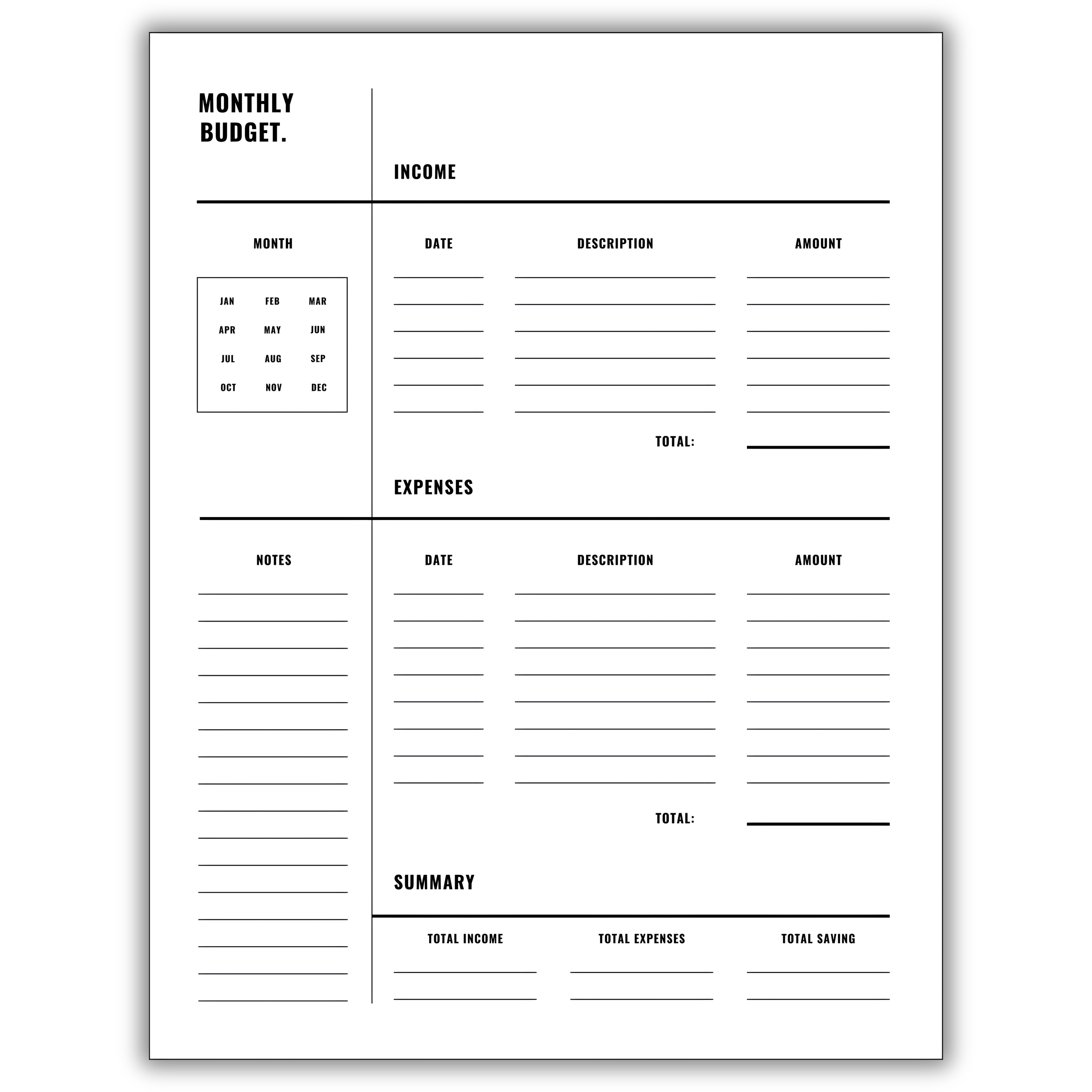

Complete Ingredient Profile of Each Page

Every page of this budget planner is structured to give you a complete financial snapshot at a glance.

-

Header & Month Selector: A bold “Monthly Budget” title anchors the top left, paired with a convenient “Month” grid (JAN–DEC) so you can circle the current month, making it easy to start anytime.

-

Income Tracker: The top-right section features a detailed “Income” log with columns for Date, Description, and Amount, allowing you to record multiple revenue streams, such as salary, side hustles, or dividends.

-

Expense Tracker: The middle section is dedicated to “Expenses,” offering ample lines to itemize bills, groceries, rent, and discretionary Spending, ensuring no cost goes unnoticed.

-

Notes Section: A vertical “Notes” column on the left provides space for reminders about upcoming bills, financial goals, or reflection on Spending habits.

-

Summary Dashboard: The bottom of the page features a powerful “Summary” block that calculates Total Income, Total Expenses, and Total Savings, giving you the bottom-line truth about your monthly performance.

How the Budget Planner Ingredients Work Together

The layout of this budget planner creates a logical flow for financial management. You begin by identifying the month, then logging your expected or actual inflows in the” Income” section.

As the month progresses, the “Expenses” log becomes your daily check-in, forcing you to confront where your money is going in real time.

The “Notes” section captures the qualitative side of money—like “cancel unused subscription” or “save for car repair”—keeping your strategy top of mind.

Finally, the “Summary” section at the bottom acts as your monthly report card, showing you exactly how much you saved (or overspent), which is the critical data point needed to adjust your behavior for next month. This cycle of Record → Review → Refine is the secret to long-term financial freedom.

Features for Financial Clarity

This budget planner shines because of its simplicity. The minimalist black-and-white design ensures that your numbers are the star of the show, free from distracting colors or unnecessary graphics.

The 8.5×11 inch format offers generous writing space, so you never have to cram multiple transactions onto a single line.

For KDP sellers, this interior is a perennial best-seller that appeals to a broad audience—from college students to retirees.

The no-bleed design ensures perfect printing every time, whether you are producing a bound book or printing loose-leaf pages for a binder. It is a versatile, professional tool that respects your money and your time.

Practical Usage Instructions and Dosage

To maximize your results, treat this budget planner as your monthly money meeting. At the start of the month, circle the month in the grid and list your expected fixed income and fixed expenses (rent, insurance, etc.).

Throughout the month, spend five minutes each Friday evening logging variable expenses, such as dining out or shopping. At the end of the month, tally up the totals in the “Summary” section to see your savings rate.

Treat one page as a single monthly “dose” of financial reality; with 120 pages, you have 10 years’ worth of monthly budgets in one file! Consistent use will reveal Spending leaks you never knew existed and help you hit your savings targets faster.

Solving Common Money Pain Points

Many people avoid budgeting because it feels overwhelming or restrictive. This budget planner solves that by simplifying the process into three easy steps: Income, Expenses, and Summary.

It eliminates the “ostrich effect” (hiding from your bank balance) by providing a safe, structured place to write down everything.

The “notes” section explicitly addresses the anxiety of forgetting irregular bills by giving you a place to park those reminders.

By visually connecting your income to your expenses on one page, you can see the math and make more intelligent choices without feeling deprived.

Ideal for You, Your Partner, and Your Household

This budget planner is a game-changer for couples and families. If you share finances, print a page and sit down together once a month for a “money date.”

Use the “Notes” section to agree on shared goals, such as “Summer Vacation Fund” or “Debt Payoff.” For roommates, it is a neutral way to track shared household expenses.

Even for solo users, it acts as an accountability partner that never judges, only reflects the truth. Whether you are merging finances or managing your own empire, this tool creates a shared language of fiscal responsibility.

Wealth Building

Stop wondering where your money went and start telling it where to go. Equip yourself with a tool that turns financial stress into an economic strategy.

Whether you are paying off debt, saving for a home, or just trying to spend less than you earn, this Minimalist Monthly Budget Planner is your roadmap to a richer life.

Download it today, print your first page, and take the first step toward mastering your money. Invite your partner to join the journey—because building wealth is a team sport. Invest in your financial freedom today.

This product includes full commercial rights. Buyers may use, print, sell, modify, and distribute unlimited copies with no restrictions or royalties.

Reviews

There are no reviews yet.